Evaluation of the On-Reserve Income Assistance Program

Evaluation, Performance Measurement

and Review Branch

October 2018

PDF Version (375 Kb, 49 Pages)

Table of contents

Executive Summary

Program Profile

Indigenous Services Canada's (ISC) Income Assistance Program is a component of Canada's social safety net. It is a program of last resort, meant to ensure that eligible individuals and families residing on-reserve receive funds to cover the basic expenses of daily living and to support their transition to self-sufficiency.

Evaluation Scope

The Evaluation, Performance Measurement and Review Branch (EPMRB), in compliance with the Treasury Board Policy on Results and the Financial Administration Act, conducted an evaluation of this program to provide a neutral and evidence-based assessment of its relevance and performance, and to inform decision making and future directions. The evaluation reviews the impact of the following grant and contribution programs: contributions to Financial Transfer Agreement; contributions to provide Income Support to on-reserve residents; and, grants to provide income support to on-reserve residents.

Methodology

The Terms of Reference for the evaluation was approved by the former Indigenous and Northern Affairs Canada (INAC) Evaluation, Performance Measurement and Review Committee on September 12, 2016. Preliminary planning work was undertaken between September 2016 and November 2016, with primary field research conducted between December 2016 and April 2017. The work was led by an evaluation team from EPMRB at INAC, with site visit support provided by the consulting firm Ference and Company.

A total of 20 site visits were conducted in: British Columbia; Manitoba; Ontario; Quebec; Alberta; and Saskatchewan. Site visits included interviews with: chiefs and community leadership; Income Assistance service delivery staff members; representatives of tribal councils; third-party delivery organizations; Income Assistance recipients; INAC regional office staff; and, provincial government representatives. The following lines of evidence were used to collect information: document review; literature review; quantitative data analysis, key informant interviews with academics; and, a financial review.

Findings

The Income Assistance Program addresses a continued need and is highly relevant to the objectives of the Department and the Government of Canada. This need is partially driven by: the historical and ongoing impacts of the reserve system; the legacy of residential schools, including extensive poverty; and, a lack of economic opportunities in some areas. However, the program's performance needs improvement, in collaboration with First Nations stakeholders.

The program has two primary goals. First, it aims to help eligible clients and their dependents meet their basic needs and second, to transition to self-sufficiency. On the first, the evaluation finds that Income Assistance serves to mitigate abject poverty, but clients largely reported feeling unable to meet their basic needs, even while receiving Income Assistance benefits.

Since 1964, Income Assistance has aimed to align the amount it pays to clients with provincial and territorial Income Assistance rates. The evaluation found that the program has achieved this goal. However, the approach of aligning rates assumes parity in historical, cultural, social, and labour market realities between communities on- and off-reserve, which this evaluation finds is not the case. The goal of rate alignment also leaves the Government of Canada out of the decision making process regarding Income Assistance rates and thus unable to respond to some on-reserve challenges, such as provincial / Yukon rates not having kept up with inflation or covering rising costs of living.

A focus on the second goal – the transition to self-sufficiency – could curb the dependence on Income Assistance and support individual and community well-being. Activities supporting this goal, particularly active measures, show promise. The On-Reserve Income Assistance Reform Initiative, which piloted case management and active measures with 18 to 24 year olds on Income Assistance, generated considerable benefit to the communities that participated. The 2016 evaluation of the Initiative found that in 2013-2014, the year prior to implementation of the Initiative, approximately seven percent of 18 to 24 year olds exited from Income Assistance. The evaluation found that, two years after the implementation of case management and active measures, exits from Income Assistance increased to 20 percent. This suggests, along with considerable qualitative evidence, that case management and active measures have an effect on the number of individuals exiting from Income Assistance to either employment or education.

Overall, the former INAC's endeavours to implement active measures have been limited in reach and scope – particularly relative to provincial programming off-reserve. Over the past few decades, provincial Income Assistance Programs have expanded to include interventions that support self-sufficiency, including case management and active measures. As a result, the Income Assistance Program alone does not align with the services available off-reserve designed to transition clients to the workforce.

Another difference between on- and off-reserve programming is that provinces have built robust service delivery systems, aggregated to cover larger populations to ensure consistency of service. The delivery model of Income Assistance on-reserve is different. ISC provides funding to First Nations administrations, and individual case workers are often expected to perform the same duties that a team of staff would do off-reserve. Some of the provinces also have centralized Information Technology (IT) database systems that both act as a streamlined case and client management system and facilitate less burdensome and more meaningful performance reporting.

This evaluation aimed to reflect on the goal of reconciliation between the Government of Canada and Indigenous peoples. If reconciliation relates to the strength of the relationship, the Income Assistance Program presents a challenge since First Nations have not been meaningfully engaged on Income Assistance's design and delivery and because the Income Assistance Program has remained relatively unchanged since 1964.

Recommendations

As a result of these findings, it is recommended that:

- ISC co-develop a new Income Assistance policy with First Nations groups, which includes other federal departments, such as Employment and Social Development Canada, as collaborators.

- As part of the co-development process, ISC reassess the merits of provincial comparability directives, and work with First Nations groups to better ensure sufficiency and appropriateness of investments and policy directives.

- In tandem with the co-development process, ISC pursue investments to fully enable First Nations to implement case management and active measures.

- As part of the co-development process, ISC pursue invests in, and work with, First Nations organisations to develop a community capacity development strategy for Income Assistance with the aim of strengthening service delivery capacity, professional development for Income Assistance administrators, IT infrastructure, and/or aggregate service delivery organizations.

- As part of the co-development process, ISC work with First Nations organisations to develop new reporting mechanisms and protocols that respond to both community needs and public reporting requirements, without being burdensome to Income Assistance administrators.

Management Action Plan

Project Title: Evaluation of On-Reserve Income Assistance

Project #: 1570-7/12035

1. Management Response

This Management Response and Action Plan has been developed to address recommendations resulting from the Evaluation of On-Reserve Income Assistance, which was conducted by the Evaluation, Performance Measurement and Review Branch.

The Education and Social Development Programs and Partnerships Sector recognizes the findings highlighted by the evaluation regarding the relevance and performance of Income Assistance. Specifically:

- Income Assistance serves to mitigate abject poverty, however, many clients are unable to meet their basic needs;

- The policy of aligning rates and eligibility criteria with the provinces/Yukon should be reviewed to take into consideration the need to respond to the realities of on-reserve communities;

- Case management and active measures are effective and there is a need for ongoing investment in this area; and

- Investments in capacity are required support to First Nations program administrators (e.g. providing Information Technology data base systems to support program delivery).

The evaluation provides five recommendations to improve the design and delivery of the Income Assistance Program. All recommendations are accepted by the program and the attached Action Plan identifies specific activities to move towards meeting these recommendations.

The Department will proceed with implementing a five-year staged response to co-develop and implement operational and policy improvements to the Income Assistance Program. An annual review of this Management Response and Action Plan will be conducted by the Evaluation, Performance Measurement and Review Committee to monitor progress and activities.

The staged approach recognizes program complexities and provides time to engage First Nations partners and other stakeholders in a meaningful co-development process. This approach will also help ensure that any actions taken complement broader Government of Canada initiatives (e.g. New Fiscal Relationship) or changes to complementary programs (e.g. Health, Housing, and Labour Market programs).

The Department is undertaking a number of initiatives, which align with the recommendations of this evaluation. Specifically, the Department has formed working groups with First Nations in each Maritime province to strengthen relationships, conduct research and verify challenges associated with the delivery of income supports. Future work in this area will focus on administrative practices, capacity and training supports, and other supporting services available to First Nations. The Department is also working with Assembly of First Nations to improve the Income Assistance Data Collection Instrument, and host a national workshop for case managers.

2. Action Plan

| Recommendations | Actions | Responsible Manager (Title / Sector) | Planned Start and Completion Dates |

|---|---|---|---|

| 1. ISC co-develop a new Income Assistance policy with First Nations groups and other federal departments, such as Employment and Social Development Canada, as collaborators. | We do concur. | Assistant Deputy Minister, Education and Social Development Programs and Partnerships Sector | Start Date: June 2018 |

We agree with this recommendation and intend to, over a five year period, co-develop and implement operational and policy improvements to the Income Assistance Program. We intend to launch an engagement process in 2018-2019 and will subsequently revise our strategy next year to reflect the appropriate next steps based on our work with First Nations and other partners. In 2018-2019, ISC will continue to engage First Nations communities, and other stakeholders by:

In 2019-2020, ISC will assess implementation of this recommendation in partnership with First Nations groups and others. |

Completion: Status update – April 2019 |

||

| 2. As part of the co-development process, ISC reassess the merits of provincial comparability directives, and work with First Nations groups to better ensure sufficiency and appropriateness of investments and policy directives. | We do concur. | Assistant Deputy Minister, Education and Social Development Programs and Partnerships Sector | Start Date: October 2018 |

We agree that the policy of aligning rates and eligibility criteria to provinces and territories should be reviewed to take into consideration the realities of on-reserve communities. In 2018-2019, ISC will work with partners to research key areas of Income Assistance, including provincial comparability. In 2019-2020, ISC will assess implementation of this recommendation in partnership with First Nations groups and other partners. |

Completion: Status update – April 2019 |

||

| 3. In tandem with the co-development process, ISC pursue investments to fully enable First Nations to implement case management and active measures. | We do concur. | Assistant Deputy Ministers, Education and Social Development Programs and Partnerships Sector | Start Date: June 2018 |

We agree that case management and active measures are effective and there is a need for on-going investment in this area. In 2018-2019 and 2019-2020, utilizing funding provided through Budget 2018, ISC will continue to invest in case management and active measures in First Nations communities. In 2019-2020, ISC will assess implementation of this recommendation in partnership with First Nations and other partners. |

Completion: Status update – April 2019 |

||

| 4. As part of the co-development process, ISC pursue investments in, and work with, First Nations organisations to develop a community capacity development strategy for Income Assistance with the aim of strengthening service delivery capacity, professional development for Income Assistance administrators, IT infrastructure, and/or aggregate service delivery organizations. | We do concur. | Assistant Deputy Ministers, Education and Social Development Programs and Partnerships Sector and Senior Assistant Deputy Minister, Regional Operations Sector | Start Date: April 2018 |

We agree that there is a need to develop a community capacity development strategy for Income Assistance. In 2018-2019, ISC will work to support Income Assistance case workers through regional workshops and other training opportunities. In 2018-2019, ISC will work with Maritime First Nations to pilot community capacity development strategy for Income Assistance. In 2019-2020, ISC will assess implementation of this recommendation in partnership with First Nations and others partners. |

Completion: Status update – April 2019 |

||

| 5. As part of the co-development process, ISC work with First Nations organizations to develop new reporting mechanisms and protocols that respond to both community needs and public reporting requirements, without being burdensome to Income Assistance administrators. | We do concur. | Assistant Deputy Ministers, Education and Social Development Programs and Partnerships Sector and Regional Operations Sector | Start Date: April 2018 |

We agree that there is a need to develop new reporting mechanisms and protocols that respond to both community needs and public reporting requirements, without being burdensome to Income Assistance administrators. In 2018-2019, ISC will complete engagement on the Income Assistance Data Collection Instrument and take next steps to determine next steps. In 2019-2020, ISC will assess implementation of this recommendation in partnership with First Nations and others partners. |

Completion: Status update – April 2019 |

1. Background

1.1 Program Profile

Background and Description

Indigenous Services Canada's (ISC)Footnote 1 Income Assistance Program is a program of last resort intended to align with provincial social safety net programs designed to provide eligible individuals and families residing on-reserve (and in Yukon) with funds to cover the basic expenses of daily living. Income Assistance also funds pre-employment services designed to help clients and dependents transition to the workforce, primarily through an Enhanced Service Delivery pilot project that ran from 2013-2017, and, in Ontario, through First Nation delivery of the provincial Ontario Works program.

The Income Assistance Program is available to all individuals and families living on-reserve, regardless of Indian status. The client is the person in a family who is in receipt of Income Assistance funding and benefits, and the dependent is a person who resides with the client, such as the: client's spouse/partner, client's or spouse's/partner's child, or the client's or spouse's/partner's adult dependent.

There are four funding components:

- Basic needs – financial assistance to cover food, clothing and shelter;

- Special needs – financial assistance for special needs allowances for goods and services that are essential to the physical and social well-being of an Income Assistance client but not included as items of basic needs, such as special diets, appliances etc.;

- Pre-employment supports – financial assistance to support activities that may include counselling and life skills, training in essential skills, transfers of Income Assistance entitlements to training and work experience projects; and,

- Service delivery – funding provided to First Nations administrators or the host province/territory to cover service delivery.

The Income Assistance Program is funded as a matter of government policy, not as a matter of legal or treaty obligation. It is delivered in approximately 540 First Nations communities, serving approximately 83,000 clients for a total of 152,000 beneficiaries (children and other dependents). INAC's total actual spending for 2016-2017 for Income Assistance was $923.9 million (see Section 1.1.5).

Objectives and Expected Outcome

As per the 2016-17 Report on Plans and Priorities, the expected results of the program are that: eligible men and women in need use income assistance supports and services to help them meet their basic needs and transition to the workforce. Basic needs are defined as supports provided to eligible clients and dependents in order to meet the basic needs for the following general categories of support: food; clothing; shelter costs, including rent, fuel/utilities, and other shelter-related costs; and other related costs. The current expected result was revised from the 2014-15 and 2015-16 expected result of: improved participation in, and attachment to, the workforce.

In 2013-14, the expected result was reported at the level of the overall Social Development program, which also encompassed the National Child Benefit, Assisted Living, First Nations Child and Family Services, and Family Violence Prevention Programs. The expected result stated at that time was that First Nations men, women and children are engaged in advancing their participation in the labour market and take advantage of available opportunities.

In 2012-13, there were two stated outcomes of Income Assistance: 1) that First Nations men, women and children's basic needs are met; and 2) that men and women are employable and able to become and/or remain attached to the workforce. In 2011-12, the expected result was again reported at the level of overall Social Development – that First Nation individuals and families are self-sufficient, secure and safe within supportive, sustainable communities.

Throughout these iterations, the Department has almost exclusively focused on dependency rates, the use of active measures, and transitions off of Income Assistance as their main measures of results achievement. The focal desired outcome of Income Assistance, based on these stated objectives and performance measures, is that First Nations people are less reliant on it.

A key initiative to better address these desired outcomes was the pilot Enhanced Service Delivery initiative funded from 2013 to 2017 for pre-employment supports as a component of the Income Assistance Reform Initiative for clients aged 18-24. The pilot ran in over 100 First Nation communities and served close to 11,000 clients. This proactive approach was intended to help individuals move from Income Assistance dependency to leading more independent and self-sufficient lives. These pre-employment measures included basic and life skills training, formal education and career counselling, apprenticeship, and/or wage subsidies that encouraged employers to hire clients. Also, since 1998, the Government of Ontario has progressively implemented Ontario Works employment assistance services together with First Nations partners. This program provides pre-employment supports for all clients, regardless of their age.

Program History

The current design of Income Assistance originated in 1964. The founding assumption of the program was that it would be a temporary measure for poverty alleviation, providing welfare funds until Indigenous peoples were moved into the market economy and/or provincial welfare regimes. Given that Income Assistance is within provincial jurisdiction, and the federal government provides funding toward on-reserve services as a matter of policy, Canada intended to transition the program to a cost-sharing model with provinces. This model was only realized in Ontario in 1965 and, to a lesser extent, in Alberta in 1991. In all provinces, federal policy ensured that funding for on-reserve Income Assistance would match provincial rates and eligibility criteria.

In the 1990s, provinces undertook major reforms to their social assistance programs to reduce the overall dependency rate. These reforms resulted in a 50 percent reduction over ten years of the number of people reliant on social assistance. These reductions were driven by a number of measures, including a tightening of eligibility criteria and the implementation of an "active measures" approach. "Active measures" refers to programs and services aimed at increasing an individual's attachment to the labour force. They aim to interrupt the cycle of social assistance dependency rates, as opposed to more "passive cheque-cutting" approaches of simply delivering the financial benefit.

INAC's Income Assistance Program did not include the same changes as provincial and territorial reforms (though some active measures pilot projects took place in the 1970s and 1980s). While Canada has not significantly changed the Income Assistance Program design or its intended outcomes since 1964, it did change its delivery model in the 1990s by transferring the administration of Income Assistance (and other social programs) directly to band councils and First Nations organizations, while still requiring compliance with INAC policy and provincial and territorial rates and eligibility criteria.

In 2003, INAC received policy authority to pursue pre-employment activities, prompting the launch of a few related pilot projects. However, the program did not receive new funding, other than annual growth, until later in the 2000s. Funding authority to deliver pre-employment activities came a decade later, when Budget 2013 allocated $241 million over five years to implement the On-Reserve Income Assistance Reform Initiative through a joint strategy between INAC and Employment and Social Development Canada that focused on youth aged 18-24 with two components: Enhanced Service Delivery – $132 million administered by INAC – and the First Nations Job Fund – $109 million administered by Employment and Social Development Canada.

It was delivered initially in over 100 pilot First Nations, selected based on community capacity and readiness. The departments sought to increase labour market integration through proposal-based pre-employment preparation activities, career planning, help in finding a job, training and skills development, and supports such as transportation to/from work or child care costs.

Indications suggest that the On-Reserve Income Assistance Reform Initiative generated considerable benefit to those communities that participated. The 2015 evaluation of the On-Reserve Income Assistance Reform Initiative found that in 2013-2014, the year prior to its implementation, approximately seven percent of 18 to 24 year olds exited from Income Assistance. In 2014-2015, the year after its implementation, this increased by 22 percentage points to 29 percent, suggesting, along with considerable qualitative evidence, that the Initiative had an effect on the number of individuals exiting from Income Assistance to either employment or education.

The On-Reserve Income Assistance Reform Initiative had other ripple-effect benefits. It was instrumental in enhancing capacity in participating communities; particularly in Ontario where the additional funding was used to build capacity to implement the full suite of Ontario Works programming for all clients, without an age restriction. It benefited clients by enhancing their self-image and setting a positive example for their families and their communities. Employers benefited from accessing better trained, job-ready candidates. However, some of the program parameters in regions outside of Ontario – such as the age eligibility requirement of 18-24 years and the maximum length of six months for the intervention – were deemed limiting. Funding authorities for the On-Reserve Income Assistance Reform Initiative ended in March 2017 and have been extended for one year.

It is important to note that Income Assistance is not the only federal program targeting employment on-reserve. Employment and Social Development Canada's Aboriginal Skills Employment and Training Strategy program was implemented to increase Indigenous people's participation in the Canadian labour market, by fostering partnerships with the private sector and provinces and territories to support demand-driven skills development. The Aboriginal Skills Employment and Training Strategy covers a range of interventions that support the integration of Indigenous people into the labour market, including: job-finding skills and training; wage subsidies to encourage employers to hire Indigenous workers; financial subsidies to help individuals access employment or obtain skills for employment; entrepreneurial skills development; supports to help with returning to school; and child care for parents undergoing training. This evaluation, however, only reviews the efforts of Income Assistance, not of the Aboriginal Skills Employment and Training Strategy.

Program Management, Key Stakeholders and Beneficiaries

Delivery Model

ISC provides funding to First Nation communities and organizations, and reimburses the Province of Ontario under the Canada-Ontario 1965 Memorandum of Agreement Respecting Welfare Programs for Indians (also known as the 1965 Agreement and the Indian Welfare Agreement), through funding agreements. The program is delivered in all provinces and the Yukon. Since its creation in 1964, the program has aligned its rates and eligibility criteria with those of the reference province or territory.

There is no single delivery model for Income Assistance, given that program delivery is managed by individual First Nations communities or organizations and is to be aligned with the reference province/Yukon Territory with respect to eligibility criteria and rates. Key variances in regional delivery are attributed to the degree of communication between First Nation communities, ISC, and different levels of government. First Nations manage their own programming and delivery while remaining compliant with ISC policy and provincial rates and eligibility criteria. More information about the delivery models can be found in Section 5.4 of this report.

The following examples highlight some of the different delivery models currently in place: (1) Sto:lo Nation, a British Columbia tribal council, delivers Income Assistance to its community members; (2) in Alberta, Maskwacis Employment Centre provides only pre-employment services to First Nation community members; (3) in the Yukon Territory, Income Assistance is delivered directly by the ISC Yukon regional office, Self-Governing First Nations, Indian Act First Nations and Government of Yukon; and, (4) in Ontario, the funding and oversight of Ontario Works is legislated by the Province of Ontario, and is mainly delivered by First Nations communities.

Primary Delivery Groups

ISC Headquarters – Education and Social Development Programs and Partnerships:

- Set overall program direction;

- Secure funding authorities;

- Ensure consistency of core program;

- Provide policy / operational advice; and,

- Monitor and report on the program's performance and impact on reserves.

ISC Regional Offices:

- Provide advice, support, and capacity development to First Nations to support Income Assistance implementation;

- Develop funding agreements;

- Develop risk based compliance plans;

- Ensuring risk management practices are used by Income Assistance recipients; and,

- Raise awareness of the Income Assistance Program.

ISC Headquarters – Regional Operations:

- Oversee, coordinate and conduct on-site compliance reviews.

First Nation governments and organizations:

- Deliver Income Assistance in accordance with the terms and conditions set out in the funding agreement;

- Provide income assistance to all eligible persons;

- Ensure that staff are trained and internal controls are in place; and,

- Ensure reporting requirements are met and submitted to ISC.

Provinces and the Yukon: By virtue of their role in the provision of social services, including Income Assistance, provincial and territorial governments provide the reference for the establishment of the rates and eligibility criteria for the Income Assistance Program. In addition, provincial governments and the Yukon Territory government provide additional services, such as employment services and income supports for disabled persons that are available to on-reserve population.

Second Level Service Delivery Organizations: In some provinces/regions, there are second level service delivery organizations that provide administrative supports to program delivery on-reserve.

Key Stakeholders

On-reserve populations are the primary stakeholders. ISC administers funding to approximately 540 First Nations, who in turn serve approximately 83,000 clients for a total of 152,000 beneficiaries (children and other dependents). First Nations organizations deliver the program in compliance with federal government program rules and according to provincial rates and eligibility criteria.

Employment and Social Development Canada: Employment and Social Development Canada is a stakeholder because of its mandate to support pre-employment training and support to Indigenous people through its Indigenous labour market programming that included, until March 2017, the First Nations Job Fund, and the Aboriginal Skills and Employment Training Strategy.

Assembly of First Nations: The Assembly of First Nations is the national organization representing First Nation peoples in Canada. It independently explores and advocates on issues relevant to First Nations communities, including Income Assistance, and engages ISC on these topics. Health Canada, provinces, and the Territory of Yukon are also stakeholders

Program Resources

Income Assistance Program expenditures have increased 35 percent in the past decade, rising from $682.5 million in 2005-2006 to $924.0 million in 2016-2017. For more information on the factors driving program costs and on program efficiency, see Section 6.

| Vote 1: Salary and O&M |

Vote 10: G&C |

Vote 5: Capital |

Statutory | Employee Benefits Plan |

Total Forecast Spending |

||

|---|---|---|---|---|---|---|---|

| 2009-2010 | Planned | $869,000 | $766,330,500 | $0 | $0 | $51,000 | $767,250,500 |

| Actuals | $2,396,555 | $803,033,654 | $0 | $0 | $300,492 | $805,730,701 | |

| 2010-2011 | Planned | $886,287 | $796,829,411 | $0 | $0 | $53,939 | $797,769,637 |

| Actuals | $3,209,273 | $819,891,256 | $0 | $0 | $421,807 | $823,522,335 | |

| 2011-2012 | Planned | $846,287 | $816,147,820 | $0 | $0 | $57,112 | $817,051,219 |

| Actuals | $4,092,683 | $838,551,587 | $0 | $0 | $605,759 | $843,250,029 | |

| 2012-2013 | Planned | $2,043,750 | $858,305,749 | $0 | $0 | $243,023 | $860,592,522 |

| Actuals | $3,944,173 | $860,818,425 | $0 | $0 | $558,585 | $865,321,182 | |

| 2013-2014 | Planned | $3,013,610 | $862,943,482 | $0 | $0 | $429,569 | $866,386,661 |

| Actuals | $6,661,118 | $865,900,746 | $0 | $0 | $951,663 | $873,513,527 | |

| 2014-2015 | Planned | $4,099,365 | $849,120,556 | $0 | $0 | $582,944 | $853,802,865 |

| Actuals | $6,902,779 | $902,130,315 | $0 | $0 | $951,156 | $909,984,250 | |

| 2015-2016 | Planned | $4,899,176 | $887,027,052 | $0 | $0 | $652,573 | $892,578,801 |

| Actuals | $6,414,912 | $897,009,882 | $0 | $0 | $894,496 | $904,319,290 | |

| 2016-2017 | Planned | $4,231,074 | $907,250,151 | $0 | $0 | $624,091 | $912,105,316 |

| ActualsFootnote 2 | $6,969,634 | $916,094,868 | $0 | $0 | $902,734 | $923,967,237 | |

| Budgetary Financial Resources (dollars) | Human ResourcesFootnote 3 (Full Time Equivalents) | ||||

|---|---|---|---|---|---|

| 2017–2018 | 2018-2019 | 2019-2020 | 2017–2018 | 2018-2019 | 2019-2020 |

| 963,793,716 | 1,002,537,896 | 1,045,518,596 | 80 | 80 | 80 |

2. Evaluation Methodology

2.1 Evaluation Scope and Timing

The evaluation scope includes fiscal years 2009-10 to 2016-17. It was partially informed by the most recent Performance Measurement Strategy on Program 2.2 (Social Development), last updated in April 2014. The Terms of Reference for the evaluation were approved by the former INAC's Evaluation, Performance Measurement and Review Committee on September 25, 2015, and primary fieldwork occurred between October 2016 and April 2017.

The evaluation reviews the impact of the following grants and contributions: contributions to Financial Transfer Agreement; contributions to provide Income Support to on-reserve residents; and, grants to provide income support to on-reserve residents.

2.2 Evaluation Issues and Questions

The Terms of Reference and methodology for this evaluation were guided by the 2016 Treasury Board Policy on Results. The following questions guided the methodology of this evaluation. For a crosswalk of these evaluation questions and their respective findings, see Appendix B.

1. What are the key differences between the Income Assistance delivery models across Canada? Which delivery models are working well?

2. Is INAC's role appropriate in the design and delivery of Income Assistance?

3. Where First Nations' communities deliver Income Assistance, are these communities properly equipped to deliver the program? Is INAC providing appropriate support to these communities?

4. To what extent has the Income Assistance Program influenced the constructive engagement and collaborative networks with direct and indirect delivery partners (i.e., provincial/territorial governments, First Nations governments and organizations, and third-party delivery organizations) to maximize results for Indigenous peoples?

5. Is the program effectively using the best available knowledge on Indigenous well-being and labour market participation to pursue its goals?

6. Can the current Income Assistance Program be reasonably expected to achieve its expected results, including: providing eligible recipients with financial support to meet their needs; and, with services to support their transition to self-sufficiency through increased participating in the labour market?

7. Is the program meeting its expected results of: eligible individuals and families are provided with financial support to help them meet their basic needs; and, services to support their transition to self-sufficiency through increased participation in the labor market?

8. Has the income assistance program achieved its goal of aligning with the rates and criteria of the provinces and Territory of Yukon? If not, why not? Is this policy goal appropriate for those living on-reserve?

9. Is the program the most economic and efficient means of achieving outputs and progress toward outcomes?

10. Do the underlying assumptions in provincial/Yukon Territory benefit formulas make sense for Indigenous communities and do they incentivize well-being in a culturally-relevant way?

11. Is INAC's approach to Income Assistance, and supporting economic well-being on reserves, advancing reconciliation between the Government of Canada and Indigenous peoples?

2.3 Evaluation Methodology

2.3.1 Data Sources

The evaluation team used multiple research methods to explore the above evaluation issues and research questions. The evaluation's findings and conclusions are based on an analysis and triangulation of the multiple lines of evidence. The following data sources were used:

Literature Review: The evaluation team conducted an assessment of published literature related to income assistance and welfare among First Nations peoples, as well as other marginalized groups, and provincial-level strategies. Literature was sought from a variety of sources, including publications from academic, Indigenous, and community-based groups. See Annex A for the bibliography.

Review of Documentation and Files: Key documents such as legislation, previous audits and evaluations, management plans, work plans, progress reports, presentations, government completed studies/reports, government project/recipient files, briefing notes, etc. were reviewed and analyzed to understand the program historically and moving forward.

Data Analysis: Data collated and held by ISC, including financial data, was analyzed to speak to questions of performance and efficiency. The evaluators also drew from other databases, including the Canadian Census and National Household Survey, as well as external data sources such as surveys by the First Nations Information Governance Centre.

Key Informant Interviews: Insights from provincial (seven) and federal government (24) representatives, academics (three), and an Indigenous Elder (one) were conducted in order to inform the evaluation. These were semi-structured and qualitative in nature, and designed to understand the issues from multiple perspectives.

Site Visits: Site visits were particularly important due to the high degree of variability in Income Assistance delivery. They were designed to assess the extent to which different approaches to Income Assistance delivery are driving intended outcomes. The site visit methodology included a number of data collection methods to gather as much information about program design and delivery impacts as possible. They were based on site visits to First Nations communities and included interviews with: chiefs and community leadership; Income Assistance service delivery staff members; representatives of tribal councils; third-party delivery organizations; Income Assistance recipients; ISC regional office staff; and, provincial government representatives.

Communities were selected to reflect region, population, economic activity, and remoteness in these regions: British Columbia (six communities), Saskatchewan (two), Manitoba (five), Ontario (three), Alberta (one); and Quebec (three). Ten focus groups with Income Assistance recipients were conducted, and a quantitative survey was also filled out voluntarily by focus group participants (n=107).

2.3.2 Considerations

- Regional variability in Income Assistance delivery was a driving consideration in this evaluation.

- Funding authorities for the On-Reserve Income Assistance Reform Initiative expired in March 2017. Budget 2017 provided funding to continue pre-employment supports and case management for youth 18-24 years old in communities that has participated in the Income Assistance Reform Initiative.

- The evaluation leveraged previous evaluations and audits, especially the recent evaluation of the On-Reserve Income Assistance Reform Initiative, to report on existing knowledge of Income Assistance dependency rates and the efficacy of active measures.

- This evaluation is limited by existing data collection instruments and processes, which are not considered to consistently capture and program outcome information on clients. ISC faces limitations, therefore, with respect to the validity and reliability of internal data. Particularly, data collected by First Nations and submitted to ISC are summaries of caseloads reported quarterly, by variable such as gender, educational attainment, age group, etc. While caseload can be a proxy indicator for dependency, it is not in and of itself a dependency rate as it does not capture the proportion of the population that is dependent, nor does it track the movement of clients into and out of the system, as is done off-reserve. For the purpose of government reporting, and in this report, the calculation of average quarterly caseload is referred to as a "dependency rate" because individual client-level data are not captured by ISC in a way that would allow for a calculation of the actual proportion of the population dependent on Income Assistance. Additionally, there are issues of reliability of data on the total registered population, and it is very difficult to capture this by age group outside of census data, which is only captured every five years and thus regularly out of date.

2.4 Roles, Responsibilities and Quality Assurance

The Evaluation, Performance Measurement and Review Branch (EPMRB) of the former INAC's Audit and Evaluation Sector was the project authority for the evaluation, and managed the evaluation in line with EPMRB 's Quality Assurance Process, EPMRB 's Engagement Directive, and the Treasury Board Secretariat Policy on Results. The Evaluation, Performance Measurement and Review Committee, Chaired by the former INAC's Deputy Minister, reviewed the preliminary findings and the final report for approval. Case study fieldwork was conducted with the assistance of the consulting firm Ference and Company.

3. Findings: Relevance

3.1 Continued Need for Income Assistance

The Income Assistance Program addresses a continued need that is highly relevant to the objectives of the Department and the Government of Canada. This need is driven by the historical and ongoing impacts of the reserve system and the legacy of residential schools, including extensive poverty and a lack of economic opportunities in some areas.

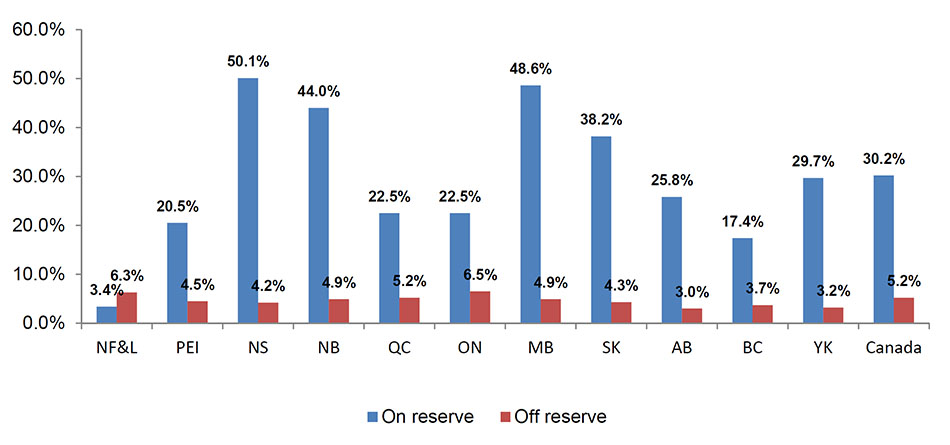

3.1.1 The Uniqueness of Income Assistance

The Income Assistance Program is a component of Canada's social safety net, meant to ensure that eligible individuals and families residing on-reserve receive funds to cover the basic expenses of daily living and pre-employment services designed to help clients and dependents transition to the workforce. The Income Assistance dependency rate (see Figure 1) – 30 percent on-reserve as of 2014, compared to 5.3 percent off-reserve – has seen only a slight decrease in the past ten years (34.6 percent in 2004-2005), despite the fact that expenditures grew 31 percent in that same period, from $649 million in 2004-2005 to $854 million in 2014-2015. These rising figures are indicative of a need that far surpasses that off-reserve, particularly given: population growth; the challenges of the reserve system as it relates to the Indian Act; the historical legacy of colonialism in Canada (see Section 3.1.2); and, remoteness, including the resultant lack of economic opportunities in remote communities. Furthermore, culturally, respondents as part of this evaluation explained that, for some of them, the notion of "packing up and leaving" to pursue job opportunities may be a far more daunting prospect than would be expected off-reserve, given cultural, historical, family and language ties to their communities.

The program responds to a relevant need, as individuals living on-reserve are in need of social supports just as are all Canadians. With the exception of Ontario (by way of the Ontario 1965 Agreement), the administration of Income Assistance on-reserve is the responsibility of the federal government, as are most other social services on-reserve. However, the need on-reserve is exacerbated and quite different, given the extent of poverty and the difficulties faced in transitioning to the workforce (including the residential schools legacy, colonisation, and their pervasive impacts) (see Section 3.1.2 for more on historical impacts and 3.1.3 for more on employment barriers).

According to the National Household Survey, the average household income in all of Canada was $79,382 in 2011. This is nearly double the average household income of those registered with Indian status living on-reserve, which was $44,370 (see Figure 2) that year. This gap is generally consistent across regions, except Quebec where the gap is markedly smaller. The labour market participation rate gap is also high. The rate was 66 percent Canada-wide in 2011, compared to 47.4 percent among those registered with Indian status on-reserve. Further analysis on dependency rates is provided in Section 4.2.1.

Figure 1: Income Assistance and Provincial Social Assistance Dependency Rates: Comparison of Provinces/Yukon Territory (2015-2016)

Description of Figure 1: Income Assistance and Provincial Social Assistance Dependency Rates: Comparison of Provinces/Yukon Territory (2015-2016)

This column chart has vertical columns representing off reserve provincial social assistance dependency rates, that are contrasted to vertical columns representing on reserve income assistance dependency rates. The y axis has percentages from 0.0% to 60.0%. The x axis lists all provinces, the Yukon territory and Canada. From left to right, the following percentages are displayed contrasting off reserve and on reserve respectively: Newfoundland and Labrador 6.3% versus 3.4%, Prince Edward Island 4.5% versus 20.5%, Nova Scotia 4.2% versus 50.1%, New Brunswick 4.9% versus 44.0%, Quebec 5.2% versus 22.5%, Ontario 6.5% versus 22.55, Manitoba 4.9% versus 48.6%, Saskatchewan 4.3% versus 38.2%, Alberta 3.0% versus 25.8%, British Columbia 3.7% versus 17.4%, Yukon 3.2% versus 29.7%, and Canada 5.2% versus 30.2%.

Figure 2: Average household income on- and off-reserve, by region 2011 National Household Survey

Description of Figure 2: Average household income on- and off-reserve, by region 2011 National Household Survey

This column chart contrasts household income by region with vertical columns for the on reserve population, that are contrasted to vertical columns for the off reserve population. The y axis has dollar amounts beginning with $0.00 to $120,000.00. The x axis lists all provinces, the Yukon territory and Canada. From left to right, the following percentages are displayed contrasting on reserve and off reserve respectively: Newfoundland and Labrador $57,000.00 versus $69,026.00, Prince Edward Island $43,934.00 versus $66,292.00, Nova Scotia $35,138.00 versus $66,292.00, New Brunswick $33,447.00 versus $65,016.00, Quebec $58,935.00 versus $66,228.00, Ontario $41,766.00 versus $85,934.00, Manitoba $33,374.00 versus $72,241.00, Saskatchewan $38,618.00 versus $78,635.00, Alberta $47,831.00 versus $101,272.00, British Columbia $48,986.00 versus $77,871.00, Yukon 88,526.00 (off reserve data only), and Canada $44,370.00 versus $79,382.

The Royal Commission on Aboriginal Peoples reported that the high level of poverty among First Nation peoples leads to higher rates of preventable diseases, violence, and suicide. These effects were corroborated by the experiences of focus group and interview participants in this evaluation and by the First Nations Regional Early Childhood, Education, and Employment Survey, which found that while only 18 percent of First Nations adults in a household earning less than $20,000 reported having excellent mental health, the figure is 44.7 percent for those earning $80,000 or more.

Income Assistance dependency is widely described by stakeholders as harmful to individual and community wellbeing. Income Assistance administrators on-reserve and ISC representatives agreed that there is no desire to be on Income Assistance; rather, that Income Assistance clients would prefer to be financially self-sufficient, and that Income Assistance dependency leaves them feeling stigmatized. This stigma has been linked to lower self-esteem, leading to negative changes in behaviour. Although Income Assistance provides some support to help with basic needs, it provides minimal support for clients to transition off of Income Assistance.

3.1.2 Historical Context

Advancing reconciliation in Canada, according to the majority of community stakeholders and confirmed in the literature, requires recognition of the fact federal social programming in general on-reserve was rooted in assimilationist policies aimed to integrate Indigenous people into the dominant Canadian society at the expense of their culture and territorial mobility. Acknowledging this history is critical to advancing reconciliation in the spirit of the United Nations Declaration on the Rights of Indigenous Peoples, and the Canadian Prime Minister's Mandate Letter to the Minister of the former INAC.

Indigenous peoples in Canada have a long history of community- and self-sufficiency through their relationship with the land and traditional means of survival. The transition from sufficiency to Income Assistance dependency started with the forced placement of Indigenous peoples onto reserve land, was entrenched by assimilationist laws such as the Indian Act, and continued through the "cultural genocide" of residential schools. This greatly diminished Indigenous peoples' knowledge and ability to pursue traditional methods of survival. Residential schools also led to intergenerational trauma, resulting in severe rates of mental health and addictions challenges on reserves, which serve as a primary barrier to self-sufficiency for many Income Assistance clients. The residential school experience remains salient today, as the majority of First Nation adults (82.4 percent) either have themselves attended or have had at least one family member who has attended an Indian Residential School.

The result of this unique historical context is that poverty on-reserve is considerably higher in some areas than off-reserve. The trajectory of wellness, which includes reconnecting with traditional culture and healing from intergenerational trauma, requires a different pathway to self-sufficiency and employment than the pathway experienced by many off-reserve. As a result of the unique challenges faced by people on-reserve, the 1964 policy to align with Income Assistance rates on- and off-reserve may require reconsideration today.

The Royal Commission on Aboriginal Peoples explains that the provision of a financial benefit may protect against absolute poverty, but it does not address the conditions that have led to dependence on Income Assistance. Though written two decades ago, the findings from Royal Commission on Aboriginal Peoples remain relevant today since the Income Assistance Program has remained relatively unchanged.

3.1.3 Barriers Faced On-Reserve

In many communities, the lack of employment opportunities for people living on-reserve is driven by a range of historical and contemporary variables. Due to the difficulties in finding full-time work that can sustain family needs, in some communities visited for this evaluation, Income Assistance was called "not a program of last resort, but the only resort."

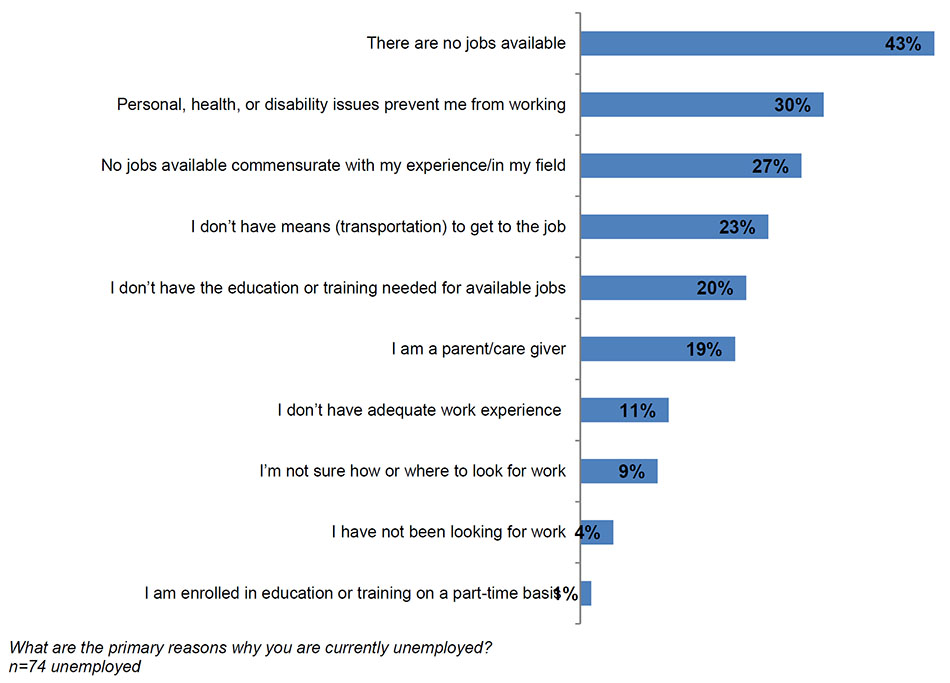

Economic Barriers

One of the major barriers to employment faced in many communities on-reserve is a lack of job opportunities, a barrier that is perpetuated by the remote nature of many reserves. Perhaps unsurprisingly, the dependency rate (calculated by the average quarterly caseload on-reserve) is highly correlated with the labour force participation rate. In fact, this was the top barrier cited by participants of the survey conducted during site visits among Income Assistance recipients (see Figure 3). While jobs are scarce, they are also often seasonal and/or part-time. As a result, the First Nations Regional Early Childhood, Education, and Employment Survey has found that of those First Nations working on-reserve, nearly one quarter (22.1 percent) had a main job located off-reserve, and the main reason was because of a lack of jobs in their community (51.7 percent).

A similar, yet less apparent, barrier is a portability issue regarding Income Assistance coverage. If an individual has a potential work opportunity off-reserve, he or she will immediately be ineligible to receive Income Assistance from the band if they leave but would be eligible to receive the same benefit off-reserve by the province. Participants in this evaluation indicated that these Income Assistance clients would sometimes have to wait several weeks, or even months, before their application for provincial income assistance was processed and a cheque released. In most cases, an individual does not have the financial security to go without Income Assistance for this amount of time while looking for work. It was also mentioned by some Income Assistance clients that they experience racism and discrimination when they attempt to find jobs off-reserve. These issues result in a disincentive to go off-reserve to look for work. Clients ought to continue receiving Income Assistance from the reserve until a fixed address is established off-reserve, and they would immediately be eligible for Income Assistance off-reserve as soon as they relocated and could even receive emergency Income Assistance from the province, but participants in this evaluation report there is a lag time in some cases.

Education

The First Nations Regional Early Childhood, Education, and Employment Survey found that while 28 percent of those who did not complete high school are employed, nearly half (49.2 percent) of those who completed high school and nearly two thirds (61.2 percent) of those who completed post-secondary education are employed.

Low rates of graduation and high rates of drop-out on-reserve result in low labour market pools and thus a high reliance on Income Assistance. First Nation participants in this evaluation spoke of the lack of incentive to complete secondary studies, given the lack of employment opportunities. This is aligned with the finding in the evaluation of Elementary/Secondary Education that indicated that the biggest determinant of graduation rate was the community's overall labour force participation rate. Not surrounded by promising labour market opportunities, fewer students complete their studies, and are thus largely ineligible for post-secondary education or many trades.

Income Assistance administrators participating in this evaluation suggested that as a result, many young adults apply for Income Assistance as a default when they turn 18. This in turn creates a culture of Income Assistance reliance, where the option of not applying for Income Assistance would put a youth at a clear disadvantage compared to their peers. Site visits to communities across Canada revealed that in First Nation communities where labour market opportunities are of greater abundance, this is less pervasive.

Mental Health

Breaking the cycle of Income Assistance dependency on-reserve requires a focus for those impacted by the intergenerational trauma of colonialism and residential schools, which have led to disproportionately high rates of mental health and addictions challenges. "Past government policies, including the systemic dispossession of land, the weakening of social and political institutions, and racial discrimination have all had lasting effects on the collective sense of identity and belonging of Aboriginal people."

For many clients, the objective of seeking supports such as counselling or rehabilitation, or connecting more deeply to their culture, may serve as helpful intermediary goals before becoming job-ready. This was an issue commonly cited by Income Assistance administrators on-reserve as key to success.

Before significant expectations of dependency reduction or labour market readiness can be instilled in social programming designed to boost labour market participation, social programming supported by ISC – and mental health supports provided by Health Canada – in general needs first to be aligned with the actual needs of communities. A significant aspect of this is culturally relevant, community-driven mental health support, including support for on-site counselling and medical services for addictions and other mental health issues stemming from residential schools and other traumas.

Second only to the availability of job opportunities, the impediment most cited by participants in this evaluation to reducing Income Assistance dependency was mental health barriers. The view was commonly held that job-readiness efforts that lacked resources for accessible mental health services resulted in case management that skipped a first essential step and left clients with a much lower probability of improved outcomes than if they had access to these services. Additional investment in mental health services – more than what is currently provided by Health Canada through the First Nations Inuit Health Branch – was seen by participants as one that could push a critical mass of clients to be job ready to the point of the investment paying for itself in the long-run with the expected drops in dependency. There has been significant investment by Health Canada in the area of mental health in the past two fiscal years, however, the effects are not yet present to participants in this evaluation.

Other

Other barriers to employment include:

- Transportation: there are limited allowances under Income Assistance for transportation for individuals to pursue job opportunities. The absence of public transportation on-reserve, and the lack of inter-city transportation, means that Income Assistance clients on-reserve are often affected more severely than Income Assistance clients living in urban centres in terms of their mobility (and therefore their ability to find and retain work). Even in communities within a reasonable distance (less than an hour) of a larger urban centre, transportation was cited as one of the top barriers in pursuing education and employment opportunities.

- Cultural incompatibility with the labour market: Traditional, subsistence economies have different guiding principles than the individualistic labour market; these economics involve the endless circulation of goods and services, centered on the sustenance of community members. For example, traditional activities that contribute to community wellness and the local economy – such as fishing, trapping, or caring for children and Elders – are all considered unpaid labour.

- Intergenerational dependency: In related case studies, the children of those on social assistance have been shown to be more likely to also receive the same benefits later in life. This evaluation finds there may be some cases of families viewing Income Assistance as a rite of passage and encouraging their members to collect it as soon as they turn 18.

- Lack of support for the transition from Income Assistance to working life: focus group participants indicated anxiety surrounding the transition phase from receiving Income Assistance to working life. Their concerns included the gap between the last Income Assistance cheque and their first pay cheque, inability to access transportation to get to and from work, and child care availability and affordability.

Figure 3: Barriers to Employment

Description of Figure 3: Barriers to Employment

This bar chart lists barriers to employment for a sample of 74 people who were asked the question "what are the primary reasons why you are currently unemployed?" The barriers to employment are listed with their according percentage in the following order from greatest to least: there are no jobs available at 43%, personal, health or disability issues prevent me from working at 30%, no jobs available commensurate with my experience/in my field, I don’t have means (transportation) to get the job at 23%, I don’t have the education or training needed for available jobs at 20%, I am a parent/care giver at 19%, I don’t have adequate work experience at 11%, I’m not sure how or where to look for work at 9%, I have not been looking for work at 4%, and I am enrolled in education or training on a part time basis at 1%.

4. Findings: Impact

4.1 Meeting Basic Needs

Aligning with provincial rates and eligibility requirements as a key pillar of Income Assistance policy assumes parity in historical, cultural and social realities, as well as labour market access, between communities on- and off-reserve, which this evaluation finds may not be the case. Many clients report struggling to meet their basic needs, which is further compounded by minimal uptake of potential financial benefits outside of Income Assistance that are available to low-income families in Canada.

The financial benefit portion of Income Assistance is intended to help eligible recipients meet their basic needs. If meeting basic needs is defined as aligning with reference province rates and eligibility, then this goal is being met, as the program effectively enables the proper distribution of Income Assistance benefits to eligible applicants. Administrators operating at the direction of the band council, or other delegated agencies, manage the intake, benefit distribution, and reporting aspects of the program. Tribal councils play a supportive role to some communities.

Assuming that "basic needs" refers to food, shelter and utilities, there is research to suggest that Income Assistance, whether on- or off-reserve, has limited reach in terms of providing for these costs on its own. Every First Nation Income Assistance administrator and Income Assistance client participating in this evaluation emphasized that most clients cannot meet these basic needs with the amounts provided to them through the Income Assistance benefit. For example, parents described feeling forced to choose between paying their hydro bill and feeding their children. Income Assistance rates have not kept pace with the cost of living. In British Columbia, for example, the consumer price index increased by 12 percent in the past ten years, while Income Assistance rates remain unchanged; the rates have also not increased in Manitoba and Saskatchewan since 2008 and not since 2011 in Alberta (discussed further in Section 5.2).

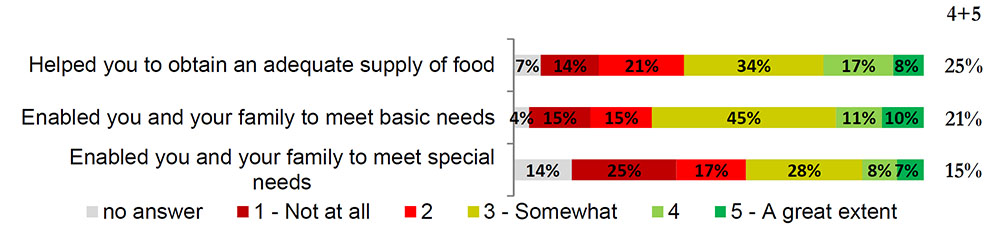

Nearly half (45 percent) of those surveyed (who participated in a focus group during site visits for this evaluation and consented to filling out a survey) rated their satisfaction with the extent to which Income Assistance "enabled you and your family to meet basic needs" a three out of five, 'somewhat satisfied' (see Figure 4). Only a small percentage of clients are satisfied with the services provided by Income Assistance. One quarter (25 percent) gave a four or five out of five rating to the degree to which Income Assistance "helped you obtain an adequate supply of food"; two in ten (21 percent) did so for "enabled you and your family to meet basic needs"; and, 15 percent did so for "enabled you and your family to meet special needs."

Figure 4: Income Assistance Outcomes (a)

On a scale of 1 to 5, where 1 is not at all, 3 is somewhat, and 5 is to a great extent, to what extent has the assistance you received from the Income Assistance Program resulted in the following: n=107 all respondents

Description of Figure 4: Income Assistance Outcomes (a)

This stacked bar chart graphically represents the responses to the following question: "On a scale of 1 to 5, where 1 is not at all, 3 is somewhat, and 5 is to a great extent, to what extent has the assistance you received from the Income Assistance Program resulted in the following? The first option, "helped you to obtain an adequate supply of food," has the following responses with: 7% who selected "no answer", 14% who selected "1 - not at all", 21% who selected "2", 34% who selected "3 - somewhat", 17% who selected "4", and 8% who selected "5 – A great extent". The second option,"enabled you and your family to meet basic needs," has the following responses with: 4% who selected "no answer", 15% who selected "1 - not at all", 15% who selected "3 -somewhat", 11% who selected "4", and 10% who selected "5 – A great extent". The third option, "enabled you and your family to meet special needs," has the following responses with: 14% who selected "no answer", 25% who selected "1 - not at all", 17% who selected "2", 28% who selected "3 -somewhat", 8% who selected "4", and 7% who selected "5 – A great extent".

The lack of ability to meet basic needs on-reserve is likely due to a lack of uptake of other financial benefits for which Income Assistance recipients may be eligible. The Canada Child Benefit, for example, is a monthly tax-free payment for families with children under the age of 18 that grants families with less than $30,000 in family net income a benefit of $6,400 per year ($533 per month) for each child under the age of six and $5,400 per year ($450 per month) for each child aged 6 to 17. There has been research to suggest that the proportion of individuals accessing the Canada Child Benefit on-reserve is lower than it could be because of lower rates of income tax filing. Interviewees participating in this evaluation suggested that more effort needs to be made on the part of the federal government to ensure that, not only band administrators, but also the general public on-reserve, are made fully aware of benefits available to them, and provided with more support in ensuring tax filing to allow payment of these benefits. A lack of uptake of the Canada Child Benefit would have significant financial implications for families with children. However, there are complications and risks for the Government in undertaking extra efforts to compel First Nation individuals to file income taxes, even if it is for the purpose of facilitating access to a substantial benefit.

4.2 Transitioning to the Workforce

Despite continued investment into the program, the Income Assistance dependency rate has only recently shown modest improvements.

4.2.1 The Dependency Rate

ISC collects data on quarterly caseloads by community. The measure most often reported is the "dependency rate", which is the quarterly caseload, averaged across a fiscal year and divided by the total population. The caseload includes dependents. While not a dependency rate per se (i.e., does not indicate the proportion of people annually dependent on Income Assistance; see Section 2.3.2 for further discussion), this indication of caseload acts as a proxy indicator of dependency in the sense that where people are no longer eligible for Income Assistance because of returning to work or school, the caseload should drop somewhat commensurate with an actual dependency rate.

These limitations notwithstanding, the dependency rate has shown a slight drop nationally over the three years from 2012 to 2017 (the most recent year where data from all regions are available) from 34 to 30 percent (within a normal range of annual variability). Data from Manitoba for 2015 were not available at the time of this analysis. Notably, however, when examining trends for all other regions to the exclusion of Manitoba for the four years between 2012 and 2015, the dependency rate decreases significantly from 29 to 25 percent.

Several regions have seen a downward trend generally in dependency, most notably British Columbia, which has decreased from an average of 31 to 17 percent from 2012 to 2017. Alberta has remained steady at about 25-26 percent, Saskatchewan at about 38 percent, Manitoba decreased to 49 percent, and Ontario at about 23 percent. Quebec has seen a steady drop from 29 percent to 23 percent, and Atlantic has seen a large and steady drop from 54 percent to 38 percent.

In Quebec and Ontario, there was a strong relationship between dependency and remoteness, but this relationship is not apparent in other regions. Generally, a more consistent relationship is found between labour force participation and dependency across all regions. This is intuitive, but speaks to the need to comprehensively address obvious labour market access realities faced on-reserve.

Participants in this evaluation emphasized that, during the same time the dependency rate decreased, the federal government also engaged in a significant compliance effort with the goal of recovering funds that did not meet compliance requirements with respect to client eligibility or rates, which may partially explain some of the decrease. Communities interviewed for this evaluation felt resources were primarily recovered due to client files not being maintained such that documentation required to attest to the eligibility of the client to receive Income Assistance, rather than actual problems of eligibility. As a result, it is likely that the modest decrease in dependency is at least partially due to factors external to the success of the Income Assistance Program.

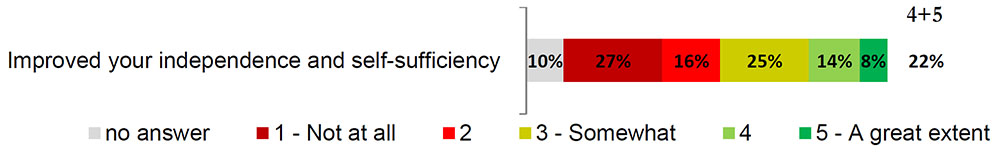

4.2.2 Exits from Income Assistance

Income Assistance clients and administrators participating in this evaluation explained that Income Assistance clients would much prefer to collect a paycheck than the Income Assistance disbursement. When asked about Income Assistance in a survey, only 22 percent of focus group participants responded with four or five out of five. This low result may be due to the small number (approximately 100) of communities that piloted the Income Assistance Reform Initiative (which is widely viewed as successful). Importantly, almost all of the communities visited in this study received support for Enhanced Service Delivery (see Section 5.1 for more on this initiative) or had some form of active measures and/or client case management.

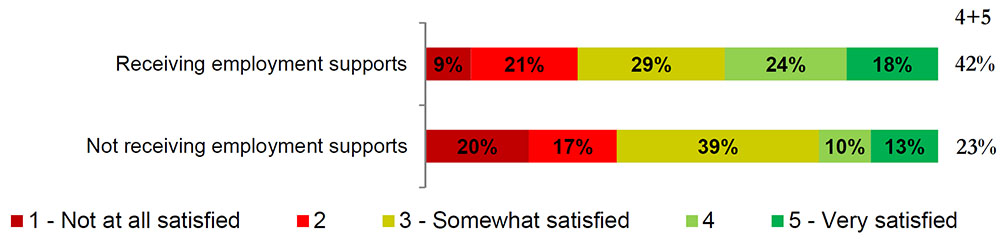

Furthermore, those participants who received some type of employment support expressed a considerably higher overall satisfaction level with the Income Assistance Program than those that did not. Of those receiving some type of employment support, more than four in ten (42 percent) rate their overall satisfaction level a four or five out of five, while fewer than one quarter (23 percent) of those not receiving employment supports say so.

Figure 5: Income Assistance Outcomes (b)

On a scale of 1 to 5, where 1 is not at all, 3 is somewhat, and 5 is to a great extent, to what extent has the assistance you received from the Income Assistance Program resulted in the following: n=107 all respondents

Description of Figure 5 Income Assistance Outcomes (b)

This stacked bar chart graphically represents the response to the following question: On a scale of 1 to 5, where 1 is not at all, 3 is somewhat, and 5 is to a great extent, to what extent has the assistance you received from the Income Assistance Program resulted in the following: improved your independence and self-sufficiency". The responses to the question has 10% who selected "no answer", 27% who selected "1 - not at all", 16% who selected "2", 25% who selected "3 - somewhat", 14% who selected "4", and 8% who selected "5 – A great extent".

Figure 6: Overall Satisfaction with Income Assistance

How satisfied are you with the help you receive from the Income Assistance Program, on a scale of 1 to 5 where 1 is not at all satisfied, 3 is somewhat satisfied and 5 is very satisfied? n=107 all respondents (n=38 receiving employment supports, n=69 not receiving employment supports)

Description of Figure 6 Overall Satisfaction with Income Assistance

This stacked bar chart graphically represents the responses to the following question: "How satisfied are you with the help you receive from the Income Assistance Program, on a scale of 1 to 5 where 1 is not at all satisfied, 3 is somewhat satisfied and 5 is very satisfied? The first option, "receiving employment supports," has the following responses with: 9% who selected "1 - not at all satisfied", 21% who selected "2", 29% who selected "3 – somewhat satisfied", 24% who selected "4", and 18% who selected "5 – very satisfied". The second option,"not receiving employment supports," has the following responses with: 20% who selected "1 - not at all satisfied", 17% who selected "2", 39% who selected "3 – somewhat satisfied", 10% who selected "4", and 13% who selected "5 – very satisfied".

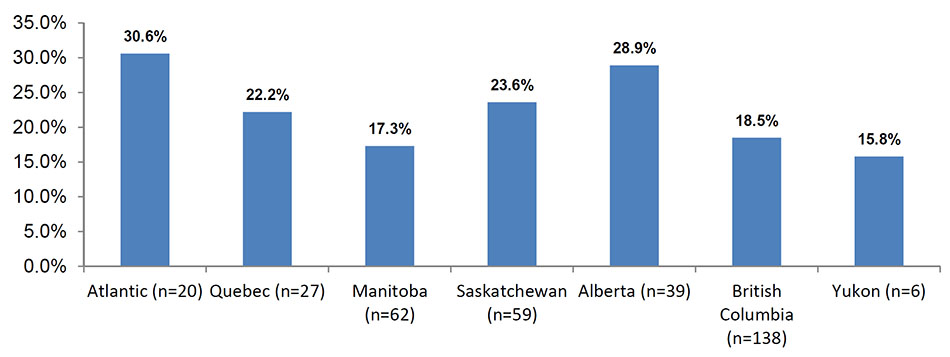

Examining Income Assistance data, exits from Income Assistance to employment or education are captured much the same way as dependency; that is, there are a number of clients logged as having "exited" in each quarter, and this is then averaged across the four quarters. The issue with this is that there is no indication of the total number of people who exited and/or re-entered the Income Assistance system in a given year. However, a caseload per quarter can be compared to the exiting caseload per quarter to give an indication of movement off the Income Assistance system. An analysis of 2015 data for the 18-24 age group (except in Ontario, where age-specific data is not collected) shows a national average caseload exiting at about 20 percent per quarter. This varies significantly by region as shown in Figure 7.

Figure 7: Regional Average Quarterly Caseload Exits for Clients 18-24 Years Old for 2015-16 (Ontario excluded. 'n' refers to number of communities reporting.)

Description of Figure 7 Regional Average Quarterly Caseload Exits for Clients 18-24 Years Old for 2015-16 (Ontario excluded. 'n' refers to number of communities reporting.)

This column chart displays regional average quarterly caseload exits for clients 18-24 years old for 2015-2015 with vertical columns. The y axis has the quarterly percentage of caseload exits for clients aged 18-24, with a range from 0.0% to 35.0%. The x axis lists the regions of Atlantic, Quebec, Manitoba, Saskatchewan, Alberta, British Columbia and the Yukon. From left to right, the following percentages are displayed: Atlantic at 30.6% with a sample size of 20, Quebec at 22.2% with a sample size of 27, Manitoba at 17.3% with a sample size of 62, Saskatchewan at 23.6% with a sample size of 59, Alberta at 28.9% with a sample size of 39, British Columbia at 18.5% with a sample size of 138, and the Yukon at 15.8% with a sample size of 6.

5. Findings: Effectiveness

5.1 Efforts to Reduce Dependency

Program resources focus almost entirely on the financial benefit portion of the Income Assistance Program. Activities supporting the goal of helping clients transition to self-sufficiency and attachment to the labour force, particularly "active measures," despite showing promise, are limited in reach and scope; particularly relative to supports available off-reserve. Additionally, the suite of services available to Income Assistance clients in provincial regimes, particularly case management, is more comprehensive than the services available on-reserve.

One of the two main outcome statements for Income Assistance emphasizes labour force attachment; the implication being that efforts should be made to interrupt the cycle of Income Assistance dependency. However, program resources focus almost entirely on the financial benefit portion of the program. Nationally, in 2015, expenditures dedicated to reducing dependency such as employment and training supports and supports through Enhanced Service Delivery, represented only 3.7 percent of total expenditures, or approximately $27 million of a total $709 million expended among communities with completed reports for 2015 (3.2 percent for communities with no Enhanced Service Delivery, and six percent for communities with Enhanced Service Delivery). One hundred and forty-five of the 474 having completed financial reporting for 2015 (about 30 percent) had funding from ISC for some form of active measures.

Importantly, among the communities with some degree of support for active measures from INAC in 2015, there was a significant relationship between the level of investment in active measures and the overall dependency rate (the greater proportion of total budget allocated to active measures, the lower the total rate of dependency as measured by average quarterly caseload). For the former INAC's Enhanced Service Delivery pilot, which served close to 11,000 clients in over one hundred communities, clients could receive a comprehensive assessment of their needs, referrals to other services available in the communities, and access to employment counsellors to develop action plans and supports for obtaining work. This pilot expired in March 2017 and it was not renewed, though the funding was extended for an additional year under the Income Assistance authorities.

In reviewing the community-level data for client outcomes from the most recent two years of data (2014-15 and 2015-16) for all regions except Ontario (where the Enhanced Service Delivery component was handled differently given the existence of active measures under the Ontario Works program), there were indications of positive outcomes. Counting the dependency rate of individuals aged 18-24 who participated in active measures out of the total dependency rate of 18-24 year olds, this proportion was significantly higher for communities with versus without Enhanced Service Delivery (average of 22 percent versus eight percent, respectively, of the average quarterly caseload for men, and 19 percent versus seven percent for women ). There is also a significant correlation between the level of investment (proportion of total expenditures) and the proportion of clients aged 18-24 participating in active measures, for both men and women.

While there was no difference between communities with or without Enhanced Service Delivery with respect to the numbers of 18-24 year olds reporting employment earnings, the average quarterly caseload exits to employment or education were significantly higher for men (25 percent versus 17 percent) and somewhat higher for women (29 percent versus 26 percent). Given the limited time and reach of these initiatives, these figures indicate a promising outcome where investments in active measures are enhanced.

The guiding principle behind "active" case management, as opposed to "passive" measures of having only the disbursement in place, is to ensure there are case managers to have effective relationships with clients and support them in achieving their specific goals. Programs for recipients could include a wide range of services, including job search assistance, basic education, skills training and work experience programs.